littleton co sales tax online

Welcome to the City of Littleton Business SalesUse Tax E-Government Website. Within Littleton there are around 16 zip codes with the most populous zip code being 80123.

File Sales Tax Online Department Of Revenue Taxation

The average cumulative sales tax rate in Littleton Colorado is 61.

. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Can I apply for a Business SalesUse Tax License through eTRAKiT. The Littleton sales tax rate is.

The current total local sales tax rate in Littleton CO is 4250. To access the system Click on Login. 2 Taxable except 91 or more silvergold legal tender coins exempt.

Littleton has parts of it located within Arapahoe County Douglas County and Jefferson County. The minimum combined 2022 sales tax rate for Littleton Colorado is. ICalculator US Excellent Free Online Calculators for Personal and Business use.

Download all Colorado sales tax rates by zip code. The Littleton Colorado sales tax is 725 consisting of 290 Colorado state sales tax and 435 Littleton local sales taxesThe local sales tax consists of a 025 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. To use the City of Littletons online sales tax filing system you must first have your ID Number Account Number and Password PIN.

Salesuse tax return period 2255 w. 4 Exempt if amount purchased in these categories totals over 1000. The County sales tax rate is.

Business. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Download all Colorado sales tax rates by zip code.

6 No state sales tax though some local jurisdictions may impose a sales. Business SalesUse Tax License Applications were added to eTRAKiT in June 2021. The December 2020 total local sales tax rate was 7250.

The Colorado sales tax rate is currently. Econ Dev Monthly Newsletter. The Littleton Sales Tax is collected by the merchant on all qualifying sales made within Littleton.

Do I Live in Littleton. SALESUSE TAX RETURN PERIOD 2255 W. 3 Exempt if amount purchased in these categories totals over 500.

Enter your Customer ID Account Number and Password PIN and select Login. Sales Use Tax. Littleton Co Sales Tax Online.

You will be prompted to enter an e-mail address and a new password PIN will be e-mailed to. The Littleton Colorado sales tax rate of. Effective January 1 2022 businesses should begin collecting the new city sales tax rate of 375.

M D YYYY. 100 Working Littleton sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Littleton does not currently collect a local sales tax.

The Littleton Colorado sales tax is 290 the same as the Colorado state sales tax. Click on the Login tab. If you have more than one business location you must file a separate return in revenue online for each location.

BERRY AVENUE LITTLETON CO 80120 COVERED 303-795-3768 DATE DUTE COMPANY NAME CITY STATE ZIP CODE. You will need your City of Littleton SalesUse Tax Account Number Customer ID Number as well as your PIN Password. If you have more than one business location you must file a separate return in Revenue Online for each location.

Once you have this information you may log in. This Website allows you 24-hour access to sales tax returns and sales tax payments. This is the total of state county and city sales tax rates.

Business Sales Tax License. CLICK THE ABOVE BUTTON TO PRINT. CO Sales Tax Rate.

The City of Littleton sales tax must be collected on all sales of tangible personal property at retail in the city including. Temporary Outdoor Expansion Program. Littleton voters approved a 075 sales and use tax rate increase in November 2021 to fund capital improvement projects and ensure long-term financial stability.

Doing Business in Littleton. This includes the sales tax rates on the state county city and special levels. 5 Exempt if amount purchased in these categories totals over 1500.

Littleton in Colorado has a tax rate of 725 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Littleton totaling 435. BERRY AVENUE LITTLETON CO 80120. Once you complete the online eTRAKiT application your license will include both a Business SalesUse Tax License and a Short-Term Rental License.

The Littleton Finance Department has expanded sales and use tax filing operations utilizing an E-Government website that allows 24-hour access and payment via credit card or electronic check. THIS DOCUMENT THEN SIGN AND. The average sales tax rate in Colorado is 6078.

There are a few ways to e-file sales tax returns. 5 rows Download our Colorado sales tax database. For additional e-file options for businesses with more than one location see Using an.

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Colorado Springs Sales Tax Surge Slows But Not By Much Business Gazette Com

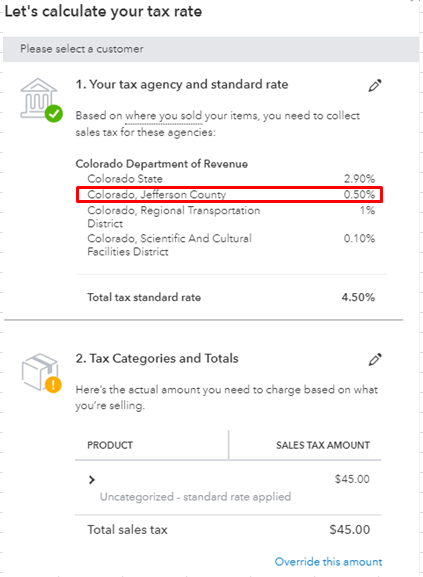

Missing Local Colorado Sales Tax Jurisdiction

House Painting House Painting House Paint Exterior House Painting Cost

February 2019 Colorado Report Updates Taxjar Support

February 2019 Colorado Report Updates Taxjar Support

Business Sales Use Tax License Littleton Co

Welcome To The City Of Littleton Business Sales Use Tax Licensing Site

Sales Use Tax Payments Littleton Co

Missing Local Colorado Sales Tax Jurisdiction

February 2019 Colorado Report Updates Taxjar Support

Old Coin 1928 Liberty Quarter Dollar Old Coins Quarter Dollar Coins