does cash app charge international fees

Does Cash App Charge Fees____New Project. To do this we may need to convert the fee amount from your sending balance into the currency in which the fee is listed in which case the fees for Conversions in all other cases also apply.

Highest Cash App Referral Code Gldpmzq 2022 Bonus

So sending someone 100 will actually cost.

. Cash App charges a 3 percent fee if you use a credit card to send money but making payments with a debit card or bank account is free. American Express which does not use Visa or MasterCard to process payments charges a 27 fee on some cards and waives the fee. For business payments the customer is charged 275.

The Cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. Heres when your Cash App will charge you a fee If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. Standard transfers on the app to your bank account take two to three days and are free while.

Credit cards typically charge the fees when customers use the. Square allows businesses to sell gift cards and track them with the Square App or Dashboard. 11 rows Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers.

When you buy or sell bitcoin using Cash App the price is derived from the quoted mid-market price inclusive of a margin or spread. So theres a man trying to send me 3000 on cash app but I got an email from cash app saying that I had to pay a 150 clearance fee. There are also fees to pay when you use the Cash App card including a 2 USD charge per ATM withdrawal⁴.

Or abroad although the current exchange rate applies for international payments. 19 rows Download the app. On the plus side Cash App charges no fees to send or receive payments in the US.

It charges the sender a 3 fee to send a payment using a credit card and 15 for an instant deposit to a bank account. 29 030 transaction rate on a customers purchase of the card. Comes with an optional free debit card.

If so the fee will be listed on the trade confirmation before you complete the transaction. Cash App charges businesses that accept Cash App payments 275 per transaction. These payments can be made in two ways.

Cards created with a template. We will collect the fee from balance in the currency in which the fee is listed. Cash App may charge a small fee when you buy or sell bitcoin.

It charges the sender a 3 fee to send a payment using a credit card and 15 for an instant deposit to a bank account. This is because Cash App uses the current mid-market exchange rate for international payments which is determined by the current buy and sell rates with no additional fee included by Cash App. There are no fees to send or request payments outside your region using Cash App.

The only time I get emails from cash app is if a transaction was made between me and another person but never for a fee. Cash App will provide the exchange rate on the payment screen before you complete it. An individual makes an in-application peer-to-peer payment to a business.

Charges a 3 processing fee when using linked credit card as a payment method Charges a 1 fee for instant cash-outs to disperse funds immediately to your bank account with no waiting period. No fees on basic services. 095each minimum 75 card pack.

Cash App uses the current mid-market exchange rate for international payments which is determined by the current buy and sell rates with no additional fee included by Cash App. Some card issuers especially travel cards charge no fee at all. Additionally there arent international payment fees for sending or requesting payment outside your region with Cash App which is massive.

You can also learn more about other Cash App fees here. In the credit card world cash advances are considered riskier and carry higher fees. When you make a payment using a credit card on Cash App Square adds a 3 fee to the transaction.

The Cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. Pricing is as follows. A maximum international fee of 499 USD Fees charged in different currencies for sending payments.

Cash App international alternatives. Cash App charges users a fee to send money via a credit card Can only send 250 every 7 days and receive 1000 every 30 days without verification Cash App is the answer of mobile credit card processor Squares parent company Block Inc to the growing popularity of peer-to-peer payments. Cash App also charges a 15 percent fee if you request an.

Foreign transaction fees are fees you may be charged if you use a debit card internationally. For business payments the customer is charged 275. Cash App doesnt charge monthly fees fees to send or receive money inactivity fees or foreign transaction fees.

I spoke to an agent named Glenn and he told me that the fee was because. Capital One doesnt charge a fee for international purchases or ATM withdrawals.

:max_bytes(150000):strip_icc()/02_Cash_App-3f22fbebe8884a73b04ca583f1baa7bf.jpg)

How To Use Cash App On Your Smartphone

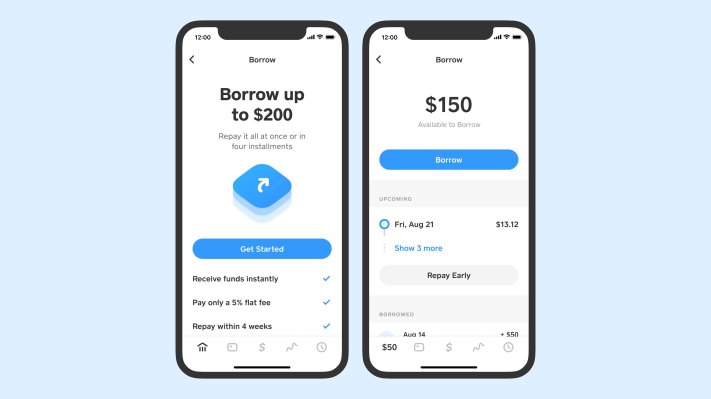

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

:max_bytes(150000):strip_icc()/01_Cash_App-c8b5e0e13c9d4bc09b0c1f0c07f43bd5.jpg)

How To Use Cash App On Your Smartphone

Cash App Taxes Review Forbes Advisor

The 10 Most Common Cash App Scams 2022

Cash App Rewards Money Transfer App Money Generator

Paypal Vs Google Pay Vs Venmo Vs Cash App Vs Apple Pay Cash Digital Trends

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

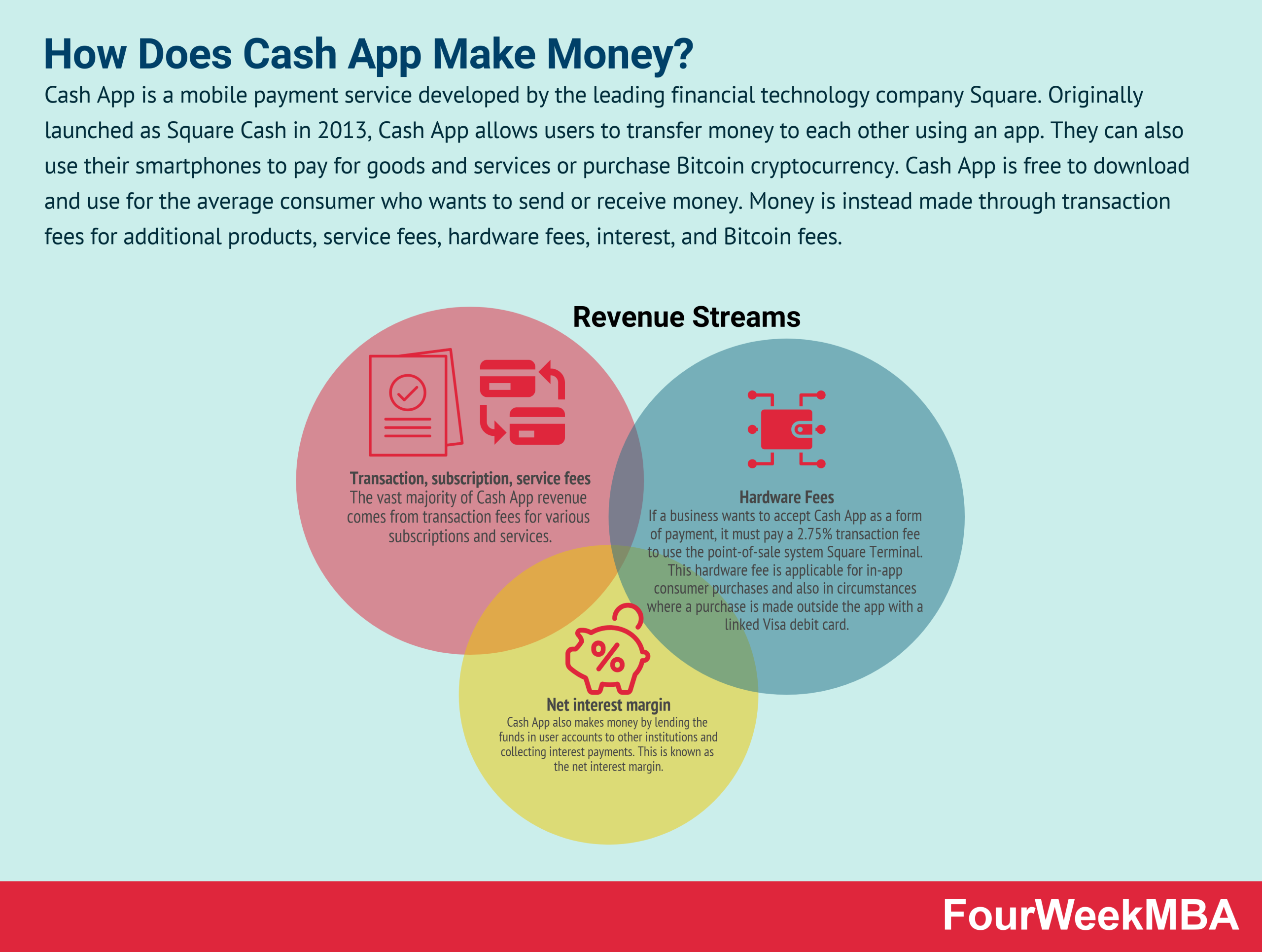

How Does Cash App Make Money Fourweekmba

Can You Use A Credit Card On Cash App Learn How To Link Your Debit Or Credit Card Here

How To Send Bitcoin On Cash App Learn How To Buy Or Withdraw Bitcoins Easily

:max_bytes(150000):strip_icc()/03_Cash_App-facb0d3923c14a1c9e5195adfe4953cf.jpg)

How To Use Cash App On Your Smartphone

What Does Pending Mean On Cash App Learn All About The Cash App Pending Status Here

Cash App International Transfers Uncovered Transumo

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method

Change Cash App Business Account To Personal Account Youtube

/Screenshot2021-11-09at11.35.14-7476aa727d4c4dae82727b2800eb6234.jpg)